Giving Guide

– Why give –

Whether you are a parent, student, alumni, faculty member, business partner, philanthropist or investor, foundation or organization, part- or full-time resident, or just a fan of College of the Desert, when you step up for College of the Desert with a membership or donation you make a significant difference in higher education, career advancement and lifelong learning.

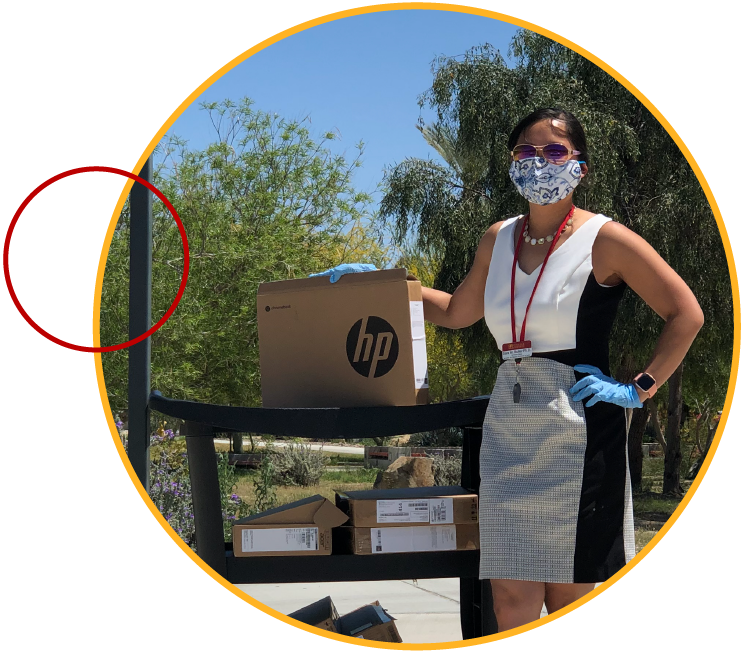

The Foundation allocated more than $1.5 million to College of the Desert last year. We depend on the private and public sectors to help underwrite

underfunded programs, services and facilities that cannot be financed through other means.

In addition to assisting the College of the Desert fulfill its commitment to student success, the Foundation offers opportunities for donors fulfill their philanthropic goals.

– Giving opportunities –

– Tax-deductible ways to give –

- Cash

- IRA distribution

- Appreciated securities

- Payroll deductions

- Real estate

- Life insurance

- In-kind donations

- Endowments

- Annuities

- Planned giving

Endowment funds raised by the Foundation will provide educational income for decades to come to support scholarships, textbooks, classroom technology upgrades, faculty positions, equipment, and other programs. A portion of all restricted donations will be used to further advancement efforts on behalf of College of the Desert. Unrestricted gifts may be used where the need is greatest.

The College of the Desert Foundation manages endowments and other assets of more than $30 million.